About Us: What We Do

At Smart Stewardship, our mission is simple: We help you minimize and eliminate taxes so that you can maximize funding for your family goals and charitable causes. It’s simple math – less in taxes means more for your family and the causes you care about. We are proactive, not reactive. We are innovative, not ordinary. When is the last time an advisor came to you with a really powerful idea?

About Us: Who We Are

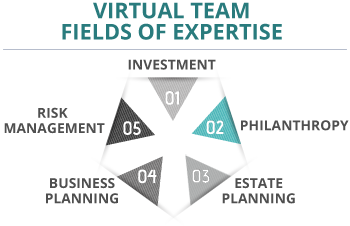

Smart Stewardship Advisors was created to offer our clients a portfolio of services to prudently manage their financial and non-financial resources for maximum gain and impact. We have built a Virtual Team of best in class professionals of various disciplines. Our goal is to facilitate a process through which wealth holders can discern wise choices regarding the accumulation, use, and distribution of financial and non-financial resources. This is Smart Stewardship.

Smart Stewardship Advisors is focused on the whole picture of your life stewardship. We do this by collectively looking at the different disciplines of personal, financial, investment, insurance and estate planning through a different lens.

Smart Stewardship Advisors is focused on the whole picture of your life stewardship. We do this by collectively looking at the different disciplines of personal, financial, investment, insurance and estate planning through a different lens.

Rich VanderSande is a graduate of Northwestern University (economics) and is a 30-year veteran of the financial services industry. He has been a participating member of several national organizations including the National Association of Family Wealth Counselors, Kingdom Advisors, and the Legacy Wealth Coach Network.

About the Principal:

Rich resides on the gulf coast of Florida with his wife and son. They enjoy traveling and playing sports of any kind. The VanderSandes actively support several ministry organizations including Biblica, Orbis and their local church.

The Financial Planning Team

Meet the experts behind our financial strategies.

Anthony Colancecco Jr.

CFP®, CRPCTM

Terri Walton Boyer

Ops Managers

Eric Stein

CFA®

Mario Nardone

CFA®

Brett Wheeler

CFP®

Jaxson Coad

Ops Specialists

Logan Tillotson

Ops Specialists

Hailey Morris

Ops Specialists

Investment Planning

Investment Planning

Smart Stewardship is keeping costs and taxes low, managing risk, and capturing the rewards created by financial markets. Our multi-faceted approach includes many factors:Our Philosophy: Bring together the influence of Ancient Wisdom and Modern Academia to build prudent portfolios for our clients.

Modern Portfolio Theory (MPT): Harry Markowitz won the Nobel Prize for his contribution to portfolio construction. The central premise of MPT is that efficient investment portfolios can be created through the process of diversification amongst asset classes with low or negative correlations. Unlike most traditional advisors, we include exposure to alternative asset classes to build more efficient portfolios.

Three Factor Model: Eugene Fama, Sr. and Kenneth French of the University of Chicago identified that there are three factors that explain investment returns in a portfolio. Until Messrs. Fama and French developed this three factor model, most investment portfolios were constructed utilizing a single factor approach. This single factor approach known as the Capital Asset Pricing Model (CAPM) posits that stocks are riskier than bonds but provide a higher return than bonds. William Sharpe (1990 Noble Prize) first expressed CAPM in the early 1960’s. Messrs. Fama and French discovered the other two factors in the early 1980’s by researching stock market returns going back to the early 1920’s.

The Role of Managed Futures: From John Lintner (Harvard) in 1983 to Ibbotson Research in 2006, the academic community has long promoted the inclusion of managed futures into already diversified portfolios. Why? Simply put, there is additional benefit to be gained with both lower volatility and expected return due to the non-correlated nature of this unique asset class.

Fiduciary Support

Fiduciary Support

Fiduciary liability is among the most threatening blind spots facing business owners today.

Overstatement? Hardly.

As a fiduciary, your personal net worth is exposed. And, over the past few years we have witnessed billions of dollars in damages in cases involving breach of fiduciary responsibility. (Source: Department of Labor) This clear, present, and expensive danger is only going to get worse.Attention! Business Owners - Are you a fiduciary? Are you at risk?

Contact us today to learn more about our solution to this very real problem. Our approach offers multiple benefits to both employer and employee. Click here to view our presentation for qualified plan sponsors.

Stewardship Mentoring and Plan Design

Our team has developed a process to help you and  your family members think and plan differently. We focus on the following areas:

your family members think and plan differently. We focus on the following areas:

1). The stewardship of what God put in your heart and in your hands

2). The stewardship of your surplus and your social capital

Our process integrates the soft side of planning with the technical and mechanical aspects of plan design and implementation.

Outcomes:

• Define and protect what you need to fund your calling.

• Build and bless your heirs.

• Give your taxes away to charity instead!

-

Contact Us Direct

-

Address

- 15715 Castle Park Terrace

Lakewood Ranch, FL 34202

Email- richv@smartstewardship.com

Phone- 224-256-2980